TPRI - some points for your reference

TPRI Tabung pengurusan rumah ibadat

some steps for the TPRI application / guidelines:

a) Documents preparation:

01) prepare all the necessary doc after reading the guidelines and samples

02) submit the doc and cover letters to LDHN as per address in the guideline

b) LHDN approval process

03) address / reply to LHDHN query / letters if any, calling the to find out which officer in charge and follow up will speed up the process

04) once you receive the approval letter, read the content, understand and make preparations to start

c) Sample receipt for approval

05) you need to prepare a sample receipt for the issuance of the tax exempt receipt upon receiving donation

06) send the sample to LHDN r review and approval, this will take shorter time

d) banking requirements:

07) prepare doc to open a separate bank accounts for the TPRI only

e) Print receipt and start

08) once you receive the approval for the sample receipt, you can start to print the receipt

09) one the receipt is ready, then you can start to issue tax exempt receipt

f) Filing, annual accounts and audit

10) have a separate filing system for doc / receipt / payment voucher in relations to TPRI matters

11) you need to get an external auditor to review and audit the annual TPRI account

12) you need to register an online tax account for TPRI, this will be separate from your existing tax account if exist

13) file annual tax return for this TPRI account and send a copy of the audit report to LDHN

14) keep all doc in store in line with records retention policy and align to tax requirements

Why an organization want to apply for TPRI:

a) To provide donors with tax exempt receipt. Donors are entitled to claim some tax relief as part of their contribution towards TPRI

b) To encourage more donors to donate more money to the your organization

What is the impact to an organization when TPRI is granted:

a) Need a separate filing and accounts for TPRI

b) All monies receive need to be keep in a bank account dedicated for TPRI

c) Organization might need to prepare two set of accounts, one for TPRI and another one for non-TPRI if there are other expenses not allowed under TPRI approval letters

d) Organization needs to adhere to the guidelines provide in the approval letters on what can be expense off / allowable under TPRI

e) Organization need to furnish relevant info on donors to the LHDN base on the requirements provided

f) LHDN officer may come to your organization to do an audit for past years records in future

I believe the guidelines are good to ensure an organization keep a proper filing and documentations towards the TPRI and expense off the expenses inline with the organization objectives.

It worth the effort if your organization receive a lot of donations. This will encourage the donors to contribute more monies for your organization!

Hope this will help you / your organization to evaluate before you decide to submit your application for TPRI

Key references for you:

Section 44(6):

http://lampiran1.hasil.gov.my/pdf/pdfam/Guidelines_Section446.pdf

Garispanduan TPRI:

http://lampiran2.hasil.gov.my/pdf/pdfam/GP_TPRI_FINAL.pdf

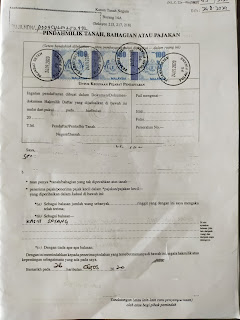

Contoh borang / peraturan:

http://lampiran1.hasil.gov.my/pdf/pdfam/PERATURAN_TPRI.pdf

some steps for the TPRI application / guidelines:

a) Documents preparation:

01) prepare all the necessary doc after reading the guidelines and samples

02) submit the doc and cover letters to LDHN as per address in the guideline

b) LHDN approval process

03) address / reply to LHDHN query / letters if any, calling the to find out which officer in charge and follow up will speed up the process

04) once you receive the approval letter, read the content, understand and make preparations to start

c) Sample receipt for approval

05) you need to prepare a sample receipt for the issuance of the tax exempt receipt upon receiving donation

06) send the sample to LHDN r review and approval, this will take shorter time

d) banking requirements:

07) prepare doc to open a separate bank accounts for the TPRI only

e) Print receipt and start

08) once you receive the approval for the sample receipt, you can start to print the receipt

09) one the receipt is ready, then you can start to issue tax exempt receipt

f) Filing, annual accounts and audit

10) have a separate filing system for doc / receipt / payment voucher in relations to TPRI matters

11) you need to get an external auditor to review and audit the annual TPRI account

12) you need to register an online tax account for TPRI, this will be separate from your existing tax account if exist

13) file annual tax return for this TPRI account and send a copy of the audit report to LDHN

14) keep all doc in store in line with records retention policy and align to tax requirements

Why an organization want to apply for TPRI:

a) To provide donors with tax exempt receipt. Donors are entitled to claim some tax relief as part of their contribution towards TPRI

b) To encourage more donors to donate more money to the your organization

What is the impact to an organization when TPRI is granted:

a) Need a separate filing and accounts for TPRI

b) All monies receive need to be keep in a bank account dedicated for TPRI

c) Organization might need to prepare two set of accounts, one for TPRI and another one for non-TPRI if there are other expenses not allowed under TPRI approval letters

d) Organization needs to adhere to the guidelines provide in the approval letters on what can be expense off / allowable under TPRI

e) Organization need to furnish relevant info on donors to the LHDN base on the requirements provided

f) LHDN officer may come to your organization to do an audit for past years records in future

I believe the guidelines are good to ensure an organization keep a proper filing and documentations towards the TPRI and expense off the expenses inline with the organization objectives.

It worth the effort if your organization receive a lot of donations. This will encourage the donors to contribute more monies for your organization!

Hope this will help you / your organization to evaluate before you decide to submit your application for TPRI

http://lampiran1.hasil.gov.my/pdf/pdfam/Guidelines_Section446.pdf

Garispanduan TPRI:

http://lampiran2.hasil.gov.my/pdf/pdfam/GP_TPRI_FINAL.pdf

Contoh borang / peraturan:

http://lampiran1.hasil.gov.my/pdf/pdfam/PERATURAN_TPRI.pdf

Comments

Post a Comment